SHENZHEN, China, Dec. 26, 2022 /PRNewswire/ — Huawei held the Top 10 Trends of Smart PV (photovoltaic) conference, with the theme of ”Accelerating Solar as a Major Energy Source”. At the conference, Chen Guoguang, President of Huawei Smart PV+ESS Business, shared Huawei’s insights on the 10 trends of Smart PV from the perspectives of multi-scenario collaboration, digital transformation, and enhanced safety.

As the proportion of renewable energy keeps increasing, the PV industry acquired a booming growth, yet, the industry still faces many challenges, including how to continue reducing the levelized cost of energy (LCOE), how to improve the O&M efficiency, how to maintain power grid stability as more renewable energy are feeding in, and how to ensure end-to-end system safety.

“Amid the rapid growth of the PV industry, these challenges also bring opportunities.” said Chen Guoguang. As a forward-looking enterprise, Huawei is keen to sharing our insights and thinking with our partners, as well as organizations and individuals who are interested in green and sustainable development.

Trend 1: PV+ESS Generator

As more renewable energy is feeding into power grids, various complex technical problems arise in terms of system stability, power balance, and power quality.

Therefore, a new control mode is needed to increase active/reactive power control and response capability, and actively mitigate frequency and voltage fluctuations. With the integration of PV and ESS as well as the Grid Forming technology, we can build ‘Smart PV+ESS Generators’ that use voltage source control instead of current source control, provides strong inertia support, transient voltage stabilization, and fault ride-through capabilities. This will transform PV from grid following to grid forming, helping increase PV feed-in.

A milestone in practice of these technologies was the Red Sea project in Saudi Arabia, which Huawei provided a complete set of solution including smart PV controller, lithium battery energy storage system (BESS) as one of the major partners. This project uses 400 MW PV and 1.3 GWh ESS to support the power grid which replaces traditional diesel generators and provides clean and stable power for 1 million people, building the world’s first city powered by 100% renewable energy.

Trend 2: High Density and Reliability

High power and reliability of equipment in PV plants will be the trend. Take PV inverters as an example, nowadays, the DC voltage of inverters is increased from 1100 V to 1500 V. With the application of new materials such as silicon carbide (SiC) and gallium nitride (GaN), as well as the full integration of digital, power electronics, and thermal management technologies, it is estimated that the power density of inverters will increase by about 50% in the next five years, and the high reliability can be maintained.

The 2.2 GW PV plant in Qinghai, China is 3100 m above sea level and has 9216 Huawei Smart PV Controllers (inverters) running stably in this harsh environment. The total availability hours of Huawei inverters exceed 20 million hours, and the availability reaches 99.999%.

Trend 3: Module-Level Power Electronics (MLPE)

Driven by industry policies and technology advancement, distributed PV has witnessed vigorous development in recent years. We are facing challenges such as how to improve the utilization of rooftop resources, ensure high energy yield, and how to ensure the PV+ESS system safety. Therefore, more refined management is a must.

In a PV system, module-level power electronics (MLPE) refer to power electronic equipment that can perform refined control on one or more PV modules, including micro inverters, power optimizers, and disconnectors. MLPE brings unique values such as module-level power generation, monitoring, and safe shutdown. As PV systems are becoming safer and more intelligent, the penetration rate of MLPE in the distributed PV market is expected to reach 20% to 30% by 2027.

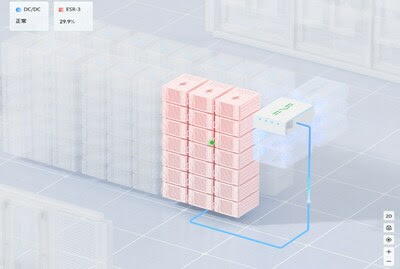

Trend 4: String Energy Storage

Compared with traditional centralized ESS solutions, the Smart String ESS solution adopts a distributed architecture and modular design. It uses innovative technologies and digital intelligent management to optimize energy at the battery pack level and control energy at the rack level. This results in more discharge energy, optimal investment, simple O&M, as well as safety and reliability throughout the lifecycle of the ESS.

In 2022, in the 200 MW/200 MWh ESS project in Singapore for the purpose of frequency regulation and spinning reserve, the largest BESS project in Southeast Asia, the Smart String ESS implements refined charge and discharge management to achieve constant power output for a longer time and ensure frequency regulation benefits. In addition, the automatic SOC calibration function at the battery pack level reduces labor costs and greatly improves O&M efficiency.

Trend 5: Cell-Level Refined Management

Similar to PV systems shifting towards MLPE, lithium BESSs are set to develop towards smaller management level. Only refined management at battery cell level can better cope with the efficiency and safety problems. Currently, the traditional battery management system (BMS) can only summarize and analyze limited data, and it is almost impossible to detect faults and generate warnings in the early stage. Therefore, BMS needs to be more sensitive, intelligent, and even predictive. This depends on the collection, computing, and processing of a large amount of data, and AI technologies to find the optimal operating mode and make forecasts.

Trend 6: PV+ESS+Grid Integration

On the power generation side, we see more and more practices of building clean energy bases of PV+ESS that supply electricity to load centers through UHV power transmission lines. On the power consumption side, virtual power plants (VPPs) become increasingly popular in many countries. VPPs combine massive distributed PV systems, ESSs, and controllable loads, and implement flexible scheduling to power generation units and storage units to achieve peak shaving etc.

Therefore, building a stable energy system that integrates the PV+ESS+Grid to support PV power supply and feed-in to grid will become a key measure to ensure energy security. We can integrate digital, power electronics, and energy storage technologies to achieve multi-energy complementation. Virtual Power Plants (VPPs) can intelligently manage, operate, and trade power of massive distributed PV+ESS systems thru multiple technologies including 5G, AI, and cloud technologies, which will come into practice in more countries.

Trend 7: Upgraded Safety

Safety is the cornerstone of the PV & ESS industry development. This requires us to systematically consider all scenarios and links and fully integrate power electronics, electrochemical, thermal management, and digital technologies to upgrade system safety. In a PV plant, faults caused by the DC side account for more than 70% of all faults. Therefore, the inverter needs to support smart string disconnection and automatic connector detection. In distributed PV scenario, the AFCI (Arc Fault Circuit Breaker) function will become a standard configuration, and the module-level rapid shutdown function will ensure the safety of maintenance personnel and firefighters. In ESS scenario, multiple technologies, such as power electronics, cloud, and AI, need to be used to implement refined management of ESS from battery cells to whole system. The traditional protection mode based on passive response and physical isolation is changed to active automatic protection, implementing multi-dimensional safety design from hardware to software and from structure to algorithm.

Trend 8: Security and Trustworthiness

In addition to bringing benefits, PV systems also have various risks, including equipment safety and information security. Equipment safety risks mainly refer to the shutdown caused by faults. Information security risks refer to external network attacks. To cope with these challenges and threats, enterprises and organizations need to establish a complete set of “security and trustworthiness” management mechanisms, including the reliability, availability, security, and resilience of systems and devices. We also need to implement protection for personal and environmental safety as well as data privacy.

Trend 9: Digitalization

Conventional PV plants have a large amount of equipment and lack information collection and reporting channels. Most of the equipment cannot ‘communicate’ with each other which is very difficult to implement refined management.

With the introduction of advanced digital technologies such as 5G, the Internet of Things (IoT), cloud computing, sensing technologies, and big data, PV plants can send and receive information, using “bits” (information flows) to manage “watts” (energy flows). The entire link of generation-transmission-

Trend 10: AI Application

As the energy industry moves towards an era of data, how to better collect, utilize, and maximize the value of data has become one of the top concerns of the entire industry.

AI technologies can be widely applied to renewable energy fields, and play an indispensable role in the entire lifecycle of PV+ESS, including manufacturing, construction, O&M, optimization, and operation. The convergence of AI and technologies such as cloud computing and big data is deepening, and the tool chain focusing on data processing, model training, deployment and operation, and safety monitoring will be enriched. In the renewable energy field, AI, like power electronics and digital technologies, will drive profound industry transformation.

At the end, Chen Guoguang remarked that the converged applications of 5G, cloud, and AI are shaping a world where all things can sense, all things are connected, and all things are intelligent. It is coming faster than we think. Huawei identifies the top 10 trends of the PV industry and describes a green and intelligent world in the near future. We hope that people from all walks of life can join hands to achieve the goals of carbon neutrality and build a greener, better future.

Photo – https://mma.prnewswire.com/

Photo – https://mma.prnewswire.com/

Photo – https://mma.prnewswire.com/

Photo – https://mma.prnewswire.com/

Photo – https://mma.prnewswire.com/

Photo – https://mma.prnewswire.com/

Photo – https://mma.prnewswire.com/

Photo – https://mma.prnewswire.com/

Photo – https://mma.prnewswire.com/